Leverage in Forex Trading: Understanding, Benefits and Risks

Feb 02, 2023

Hey y'all!

Over the years, Forex trading has become increasingly popular, attracting both novice and experienced traders alike. One of thee MOST attractive features and what makes forex trading unique is the use of leverage, which allows traders to control larger positions with a smaller investment. In this blog post, we will explore what leverage is in forex trading, why people might view it as a scam, and provide tips on how to safely use leverage to enhance your trading opportunities while minimizing risk.

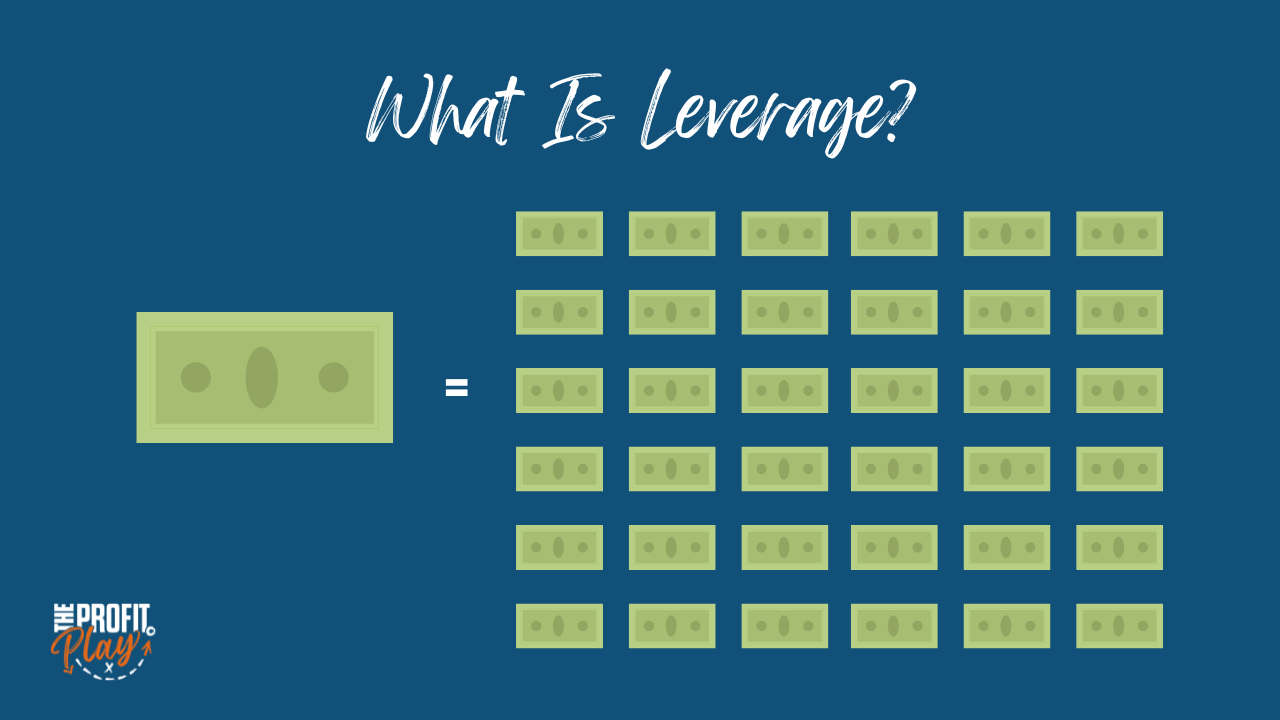

What is Leverage in Forex Trading?

Leverage is a powerful tool that allows traders to control a larger position with a smaller investment. It works by borrowing money from a broker to increase the size of your trade. For example, if you have a leverage ratio of 100:1, it means you can control a $100,000 position with only $1,000 of your own capital.

Benefits of Leverage in Forex Trading

The main advantage of leverage is that it enables traders to control larger positions with a smaller investment, increasing their potential returns. It also allows traders to access the forex market with a small amount of capital, making it accessible to a wider range of people. Additionally, leverage provides greater flexibility for traders, as they can adjust the size of their positions based on their risk tolerance and investment goals.

Why People Think Leverage is a Scam

Despite the many benefits of leverage, some people view it as a scam due to the potential for high risks. Forex trading is inherently risky, and leverage amplifies these risks. For example, if the market moves against a leveraged position, a trader can quickly lose more than their initial investment. This can lead to significant financial losses and, in some cases, can even result in a margin call, where the trader is required to deposit additional funds to cover their losses.

Tips for Safely Using Leverage in Forex Trading

To safely use leverage in forex trading, it's important to understand the potential risks and to manage your positions accordingly. Here are a few tips to help you do just that:

-

Choose a Reputable Broker: Choose a broker that is regulated and has a good reputation in the industry. This will ensure that your funds are protected and that you are dealing with a reputable entity.

-

Start with a Small Leverage Ratio: If you're new to forex trading, it's best to start with a small leverage ratio and gradually increase it as you gain more experience. This will help you manage your risk and avoid large losses.

-

Use Stop Loss Orders: Stop loss orders are a key tool for managing risk in forex trading. They allow you to set a predetermined level at which your position will be automatically closed, limiting your potential losses.

-

Limit Your Exposure: Don't put all your eggs in one basket. Diversify your portfolio by trading multiple currency pairs and limiting your exposure to any one market.

-

Keep Learning: Stay up-to-date with the latest market trends and news, and continually educate yourself on the risks and benefits of leverage in forex trading.

In short, leverage can be a powerful tool in forex trading, but it's important to understand the potential risks and to manage your positions accordingly. By following these tips, you can use leverage to enhance your trading opportunities while minimizing risk. With the right education and a solid understanding of the market, leverage can be a valuable tool for achieving your financial goals.